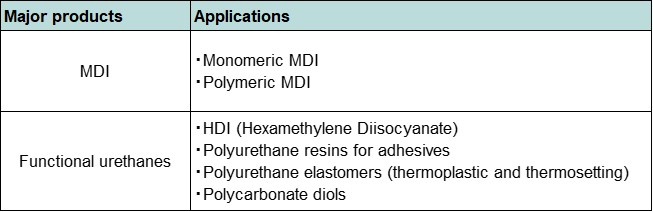

Polyurethane is utilized in various applications, including automobiles, home appliances, residences, and industrial materials. It successfully contributes to energy conservation and weight reduction.

Business Vision

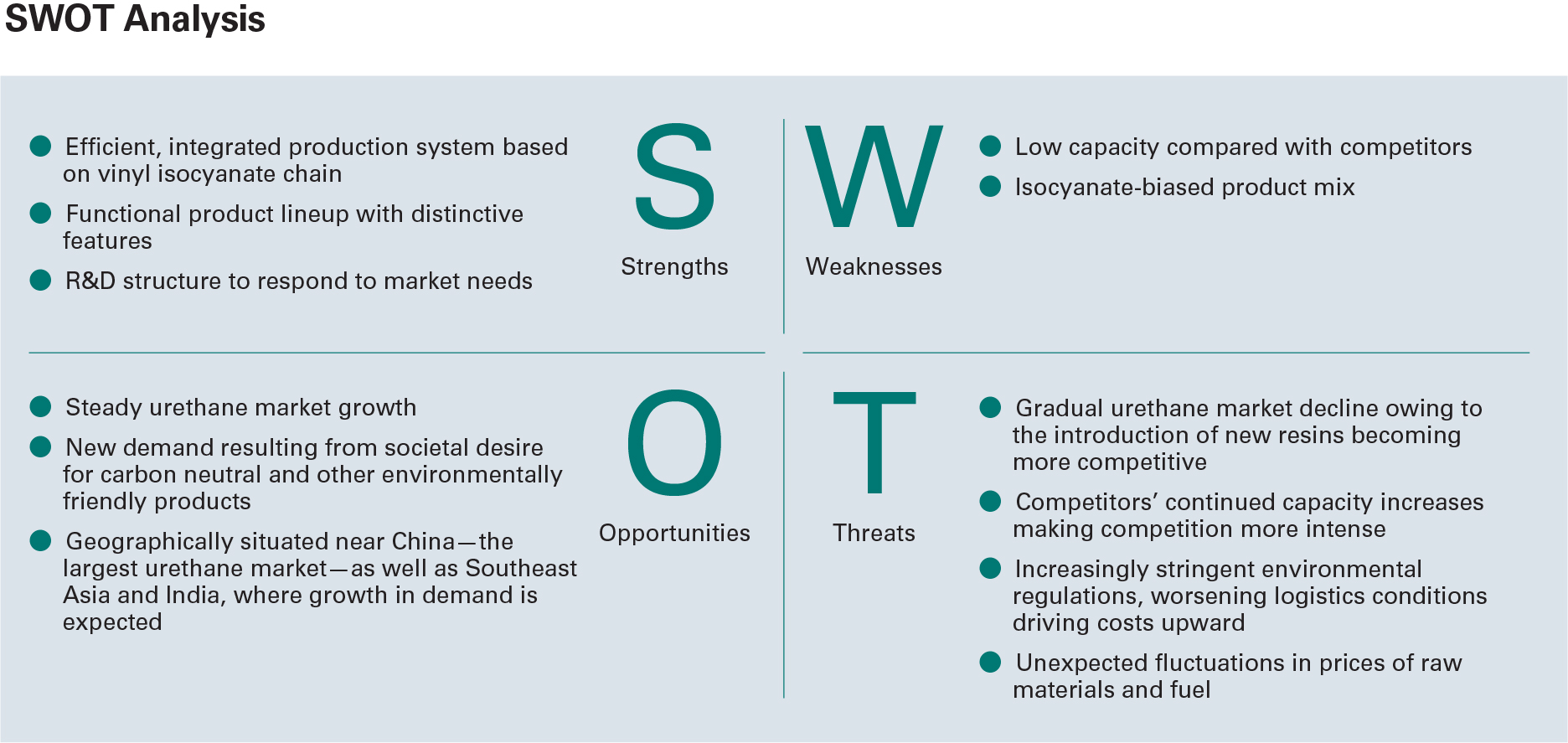

With Tosoh’s production and sales activities proceeding at full speed for its main products, it is extremely important for the company to formulate a sustainable growth strategy. Moreover, since the company’s urethane business earnings depend heavily on overseas market conditions for Methylene Diphenyl Diisocyanate (MDI), we are now looking to stabilize this business. Therefore, manufacturing, sales, and research will work collectively to stabilize and maximize profits and expand the business by reinforcing the foundation of MDI, thus growing the functional urethane business, and cultivating new businesses. With respect to climate change issues, we will endeavor to reduce GHG emissions by establishing improved manufacturing methods for polyurethane raw materials, such as isocyanates, that employ CO2 as a raw material and by improving our existing manufacturing processes.

In addition to expanding capacity for existing businesses, the entire Urethane Division will work collectively and with a sense of urgency to fully establish new isocyanate businesses and promote product development using biomass materials with the objective to cultivate new businesses.

Medium-Term Business Policy (FY2023–FY2025)

MDI

- Diversify customer base to stabilize earnings

- Promote CO2 feedstock

Functional urethanes

- Expand revenue base through increased competitive advantage and capacity expansion

Japan’s top share—MDI is used as a urethane raw material

Medium-Term Business Policy Initiatives

MDI Business Initiatives

With production and sales activities in full swing, Tosoh will work hard to bolster sales in Southeast Asia and India, where we anticipate a steady growth in demand. As part of this effort, the company plans to promote the construction of new splitters (distillation separation equipment) to become Southeast Asia’s sole MDI manufacturing company. Meanwhile, when considering domestic sales, we will continue to augment and upgrade our logistics infrastructure, placing the upmost importance on ensuring a consistent an dependable supply.

Products Certified as Social Issues Solution

- Polymeric and modified MDI for heat insulators in building material applications

- MDI Woodcure® series particle board adhesives used in building materials and furniture

Toward Specialty Business Operating Income in Excess of ¥100 Billion

Tosoh intends to proactively expand the scale of the company’s business by bolstering its solutions business. We intend to do this by developing more environmentally friendly products, creating added value, and fortifying the company’s market presence. We also plan to introduce our main product line, HDI paint curing agents, into the global marketplace. In pursuing this, competitive advantages include the agent’s non-yellowing properties, its standout feature. Additionally, being water-based and low-viscosity facilitates low-temperature curing, presenting customers the attraction of reduced VOC emissions and energy consumption.

Further downstream, for polyurethane resins, we plan to focus our attention on business development based on proposals that develop a range of grades that satisfy those characteristics required. Tosoh will also position recyclable thermoplastic polyurethane elastomers in addition to establishing self-polymerizing, energy-saving thermosetting elastomers as core products.

Differentiation Strategies

Initiatives and Social Contributions Related to Producing Urethane Raw Materials Using CO2 as a Raw Material

Tosoh has decided to construct a facility at the Nanyo Complex to recover CO2 from combustion gas and utilize it as a raw material. The objective for such a procedure is to benefit from its practical use of producing carbon monoxide (CO), a raw material for isocyanate products—a Tosoh mainstay— operation is scheduled to begin in the fall of 2024. By using this product instead of petrochemical feedstock, the company aims to reduce the carbon footprint associated with the production of polyurethane products that utilize Tosoh isocyanate products.

This initiative is being developed as part of the NEDO Green Innovation Fund Project, aiming to create production technologies for isocyanate, dialkyl carbonate, and other polyurethane raw materials by utilizing factory exhaust gas instead of phosgene. The project includes plans for constructing a pilot plant in 2026 and a commercial plant in 2030 or beyond.

Moreover, in response to growing market demand for environmentally friendly products, Tosoh intends to develop new urethane products using castor oil and other biomass raw materials. Simultaneously, the company is exploring the possibility of obtaining relevant certification.

Global Expansion of HDI and Contribution to Society

HDI, primarily utilized as a paint curing agent, provides a high performance essential for paints in terms of aesthetic and substrate protection. It ensures no yellowing and offers superior resistance to weathering. Tosoh’s lineup features a variety of curing agents modified with HDI monomers, as well as environmentally friendly agents that are water-based, featuring low viscosity, and enabling low-temperature curing. The company is also focusing on developing customized products to satisfy various customer needs.

Continued growth is forecast in the demand for paints—particularly in emerging countries. The same is thought to be true for HDI curing agents. As demand continues rising in high-end applications such as new car paints, automotive repair, and construction, Tosoh will look to rapidly expand its derivative products. The company is also actively involved in developing technologies that employ CO2 as a raw material and will endeavor to create products that address sustainability.

S Functional Product Lineup with Distinctive Features

As Tosoh operates both isocyanate and polyol businesses, this enables the company to satisfy specific customer needs in system design. And, since we beat competitors to the market with many of our products, we are completely trusted by our customers.

Further developments include creating and introducing new environmentally friendly products utilizing bio-based raw materials, and responding to diversifying needs associated with changes in the automotive industry, centered on the world’s transition to electric vehicles (EVs).

O Demand Growth in China, Southeast Asia and India

China, with its population of 1.4 billion and robust demand for urethanes, is the world's largest consumer of MDI. China also produces and exports a wide variety of products globally, therefore steady growth in demand for MDI continues.

Similarly, while demand volume in Southeast Asia and India is not as high as in China, the economic growth rate in that region is still rather high—at 5–8%—and the growth rate of MDI is expected to surpass that figure. Particular growth in demand is evident for insulation in building construction and electric refrigerators, resin for shoe soles, and spandex applications, and MDI demand is forecast to rise in line with higher living standards in the forementioned regions.