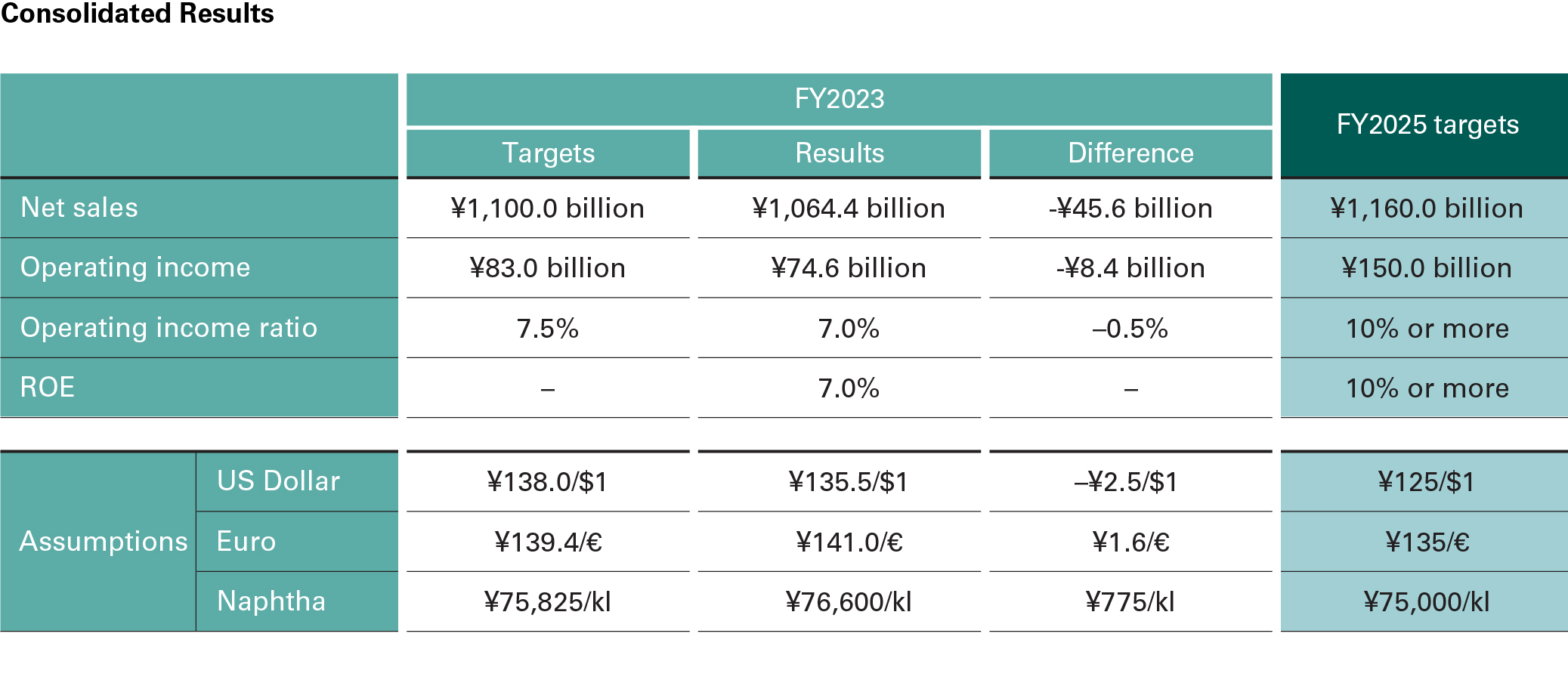

Medium-Term Business Plan (FY2023–2025)

Medium-Term Business Plan Progress

The business environment in FY2023, the first year of the three-year Medium-Term Business Plan, was characterized by soaring raw material and fuel prices, including coal, triggered by Russia’s invasion of Ukraine. At the same time, a shrinking product demand gradually became apparent owing to global economic stagnation.

Amidst these conditions, the Specialty business—centered on functional products—has steadily reinforced its operations, securing year-on-year profit growth despite the current challenging business environment. In FY2023 and beyond, we will strive to expand sales of our mainstay products through capacity expansion and continue to invest further in growth areas to achieve the performance targets outlined in our medium-term business plan.

Our Commodity business performance deteriorated in FY2023 amidst soaring raw material and fuel prices, including coal. Although a softening of these prices is expected in FY2024, we see overseas market conditions for our products remaining sluggish for the foreseeable future as the global economy’s recovery is slow and there is a lack of momentum in demand.

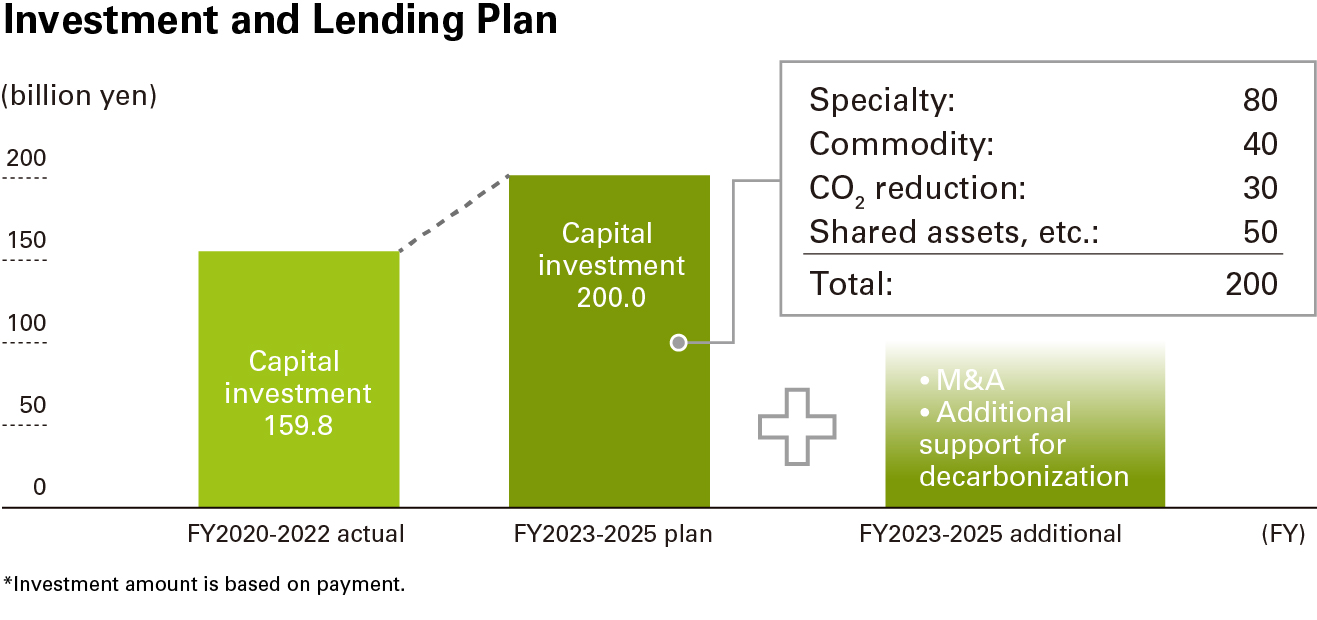

We see capital investment remaining above the ¥200 billion level, which was initially planned over a three-year period. While promoting investment for growth, we have begun introducing biomass power generation facilities—an investment toward reducing CO2 emissions—and will balance growth and decarbonization as we continue to conduct business.

Basic Management Policy

1. Focus on expanding Specialty business earnings while maintaining the dual management approach as the basis of our operations

Achieve an optimal combination of business enhancement and CO2 emission reduction, and maintain a stable supply by implementing cost sharing and price pass-on when necessary.

1. Expand earnings foundation by investing in capacity expansion in comparatively well-positioned businesses, focusing management resources on growth areas, and cultivating new businesses.

2. Make a concerted effort to reduce CO2 emissions and effectively utilize CO2

Promote decarbonization in every respect and fulfill our corporate responsibility to help realize a sustainable society.

3. Invest aggressively based on sound financial positioning

The move toward decarbonization will change the business environment dramatically, so we see this as an opportunity to invest in a timely, strategic manner in preparation for the future.

4. Reinforce safety infrastructure and establish and deepen a safety culture for everyone.

Continue efforts to reinforce safety infrastructure and establish and deepen the safety culture.

Efforts Toward Decarbonization

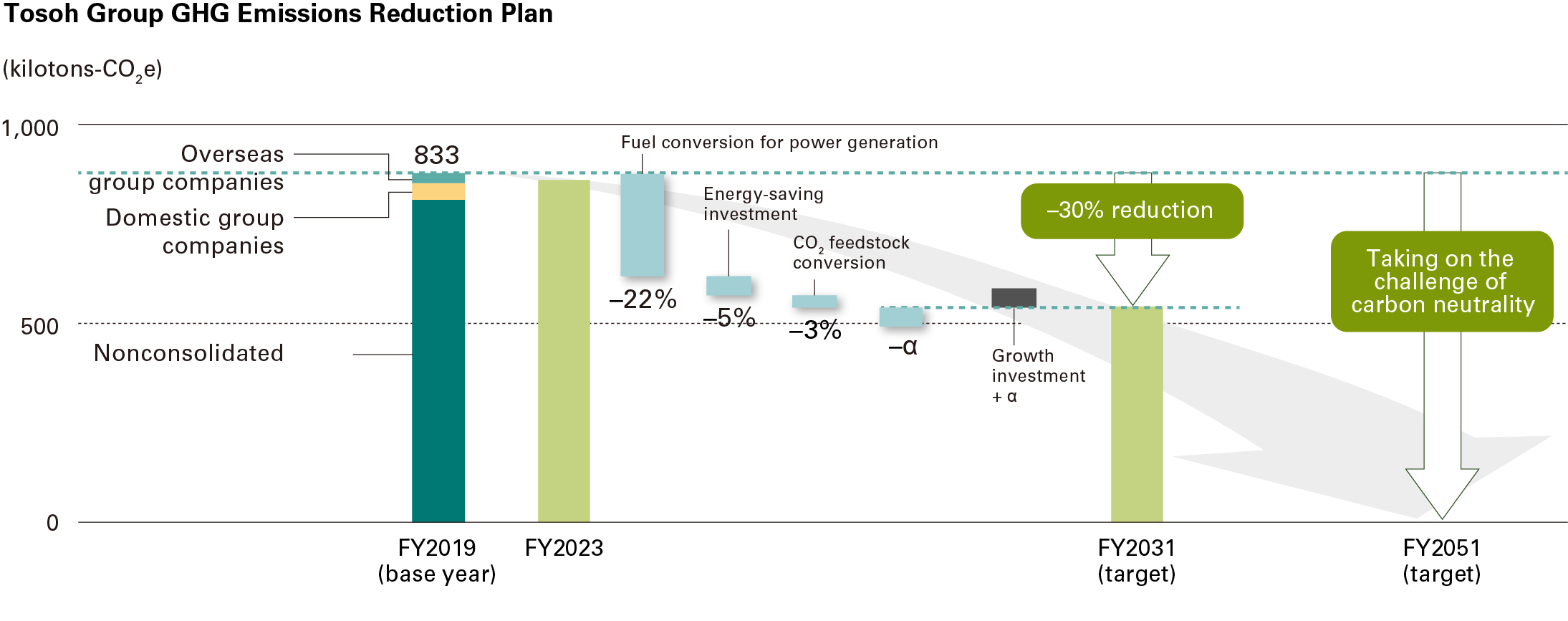

- Implement specific measures to achieve a 30% reduction in CO2 emissions by FY2031 (compared with FY2019)

- A thirty-percent reduction with current technology will chiefly be due to the conversion of wood-based biomass as fuel for power generation facilities; diversify fuels by introducing biomass power generation facilities with the view of fuel diversification.

- Chemical manufacturers are on a mission to convert CO2 feedstock; they have elevated it in terms of priority, and are strengthening their efforts to encourage improvement.

FY2023 results

- Introduce semi-carbonization facilities (increase wood-based biomass co-firing ratio)

- Undertook the construction of a new biomass power generation facility (scheduled for completion in April 2026)

- Conducted a demonstration test of CO2 recovery and conversion to feedstock

- Participated in projects: Afforestation in a joint conservation project for the production of wood for use as wood-based biomass in Shunan City, Yamaguchi Prefecture, and in Japan’s New Energy and Industrial Technology Development Organization (NEDO) Green Innovation Fund project as a member of the Matsuri Project

Investment and Lending Plan

- FY2023–2025 three-year cumulative investment = ¥200 billion in capital investment + M&A, additional support for decarbonization

- Invest aggressively with a focus on Specialty, including capital investment of ¥30 billion for CO2 reduction.

- M&A exploration focused on biotechnology-related businesses

FY2023 results (¥79.2 billion)

Capacity expansion investment

- Bromine production facility

- Separation and purification media production facilities

- Sputtering target production facilities

- Silica glass material and fabricated quartzware facilities

Investment in CO2 reduction

- Biomass power generation facilities

- CO2 recovery and raw material conversion equipment

Normal investment

- Tokyo Research Center (Biotechnology Research Annex, Customer Support Center)

R&D

- Concentrate R&D resources in the three main priority fields of life sciences, electronic materials, and environment and energy.

- Accelerate R&D by effectively leveraging research infrastructure, using MI technology to improve the efficiency of material design, promoting open innovation, and acquiring cutting-edge technologies through means such as funds allocated by the company.

Major initiatives

Details: R&D and Intellectual Property

Safety Foundation and Culture

- Continue existing and develop new initiatives toward reinforcing the safety infrastructure and fostering a culture of safety.

Major initiatives for FY2023

- Smart Security Promotion: Applying digital transformation (DX) to operations, safety, and facility management

- Upgraded safety education: Further enhancement of simulators and other educational facilities, hands-on learning devices, and hazard simulation training.

- Construction system reinforcement: Cooperating with partner companies to strengthen the safety management structure.

- Safety technology formulation: Upgrading risk assessment and training safety technology specialists.

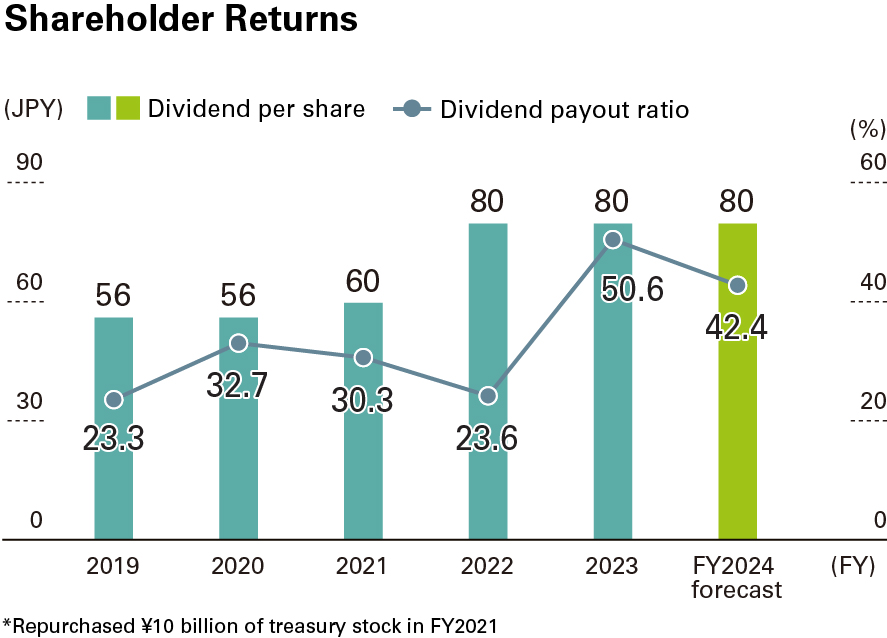

Shareholder Returns

- Our basic policy is to pay stable dividends, and we will also strive to use share buybacks to improve capital efficiency.

- Targeting a dividend payout ratio of 30%

- We will flexibly implement share buybacks, taking into account factors such as the level of free cash flow.

Climate Change Issue

Climate change is one of the world's most pressing societal issues. The Tosoh Group recognizes that contributing to the reduction of GHG emissions generated through its business activities is the single most important issue for the company’s medium- to long-term growth. As such, the company is promoting the reduction of CO2 emissions through energy savings and fuel conversion and investigations into technologies so CO2 can be managed more effectively.

In response to the Japanese government's 2050 carbon-neutral declaration, the company established a new groupwide GHG emission reduction policy in 2022. We will promptly implement a host of measures toward realizing a decarbonized society while considering Japan's energy policy trends, technological innovation, and the distribution of carbon-free fuels.

In November 2019, Tosoh declared its support for the Task Force for Climate-Related Financial Disclosures (TCFD*) recommendations. The company will continue disclosing information on Tosoh Group initiatives in line with these recommendations.

*An organization established by the Financial Stability Board to provide a framework for valuable information disclosure useful for understanding climate-related corporate risks and opportunities. In June 2017, the TCFD published recommendations related to items of information disclosure.

Yutaka Shiokawa

Vice President

General Manager, CO2 Reduction and Utilization Strategy

Information Disclosure Based on TCFD Recommendations

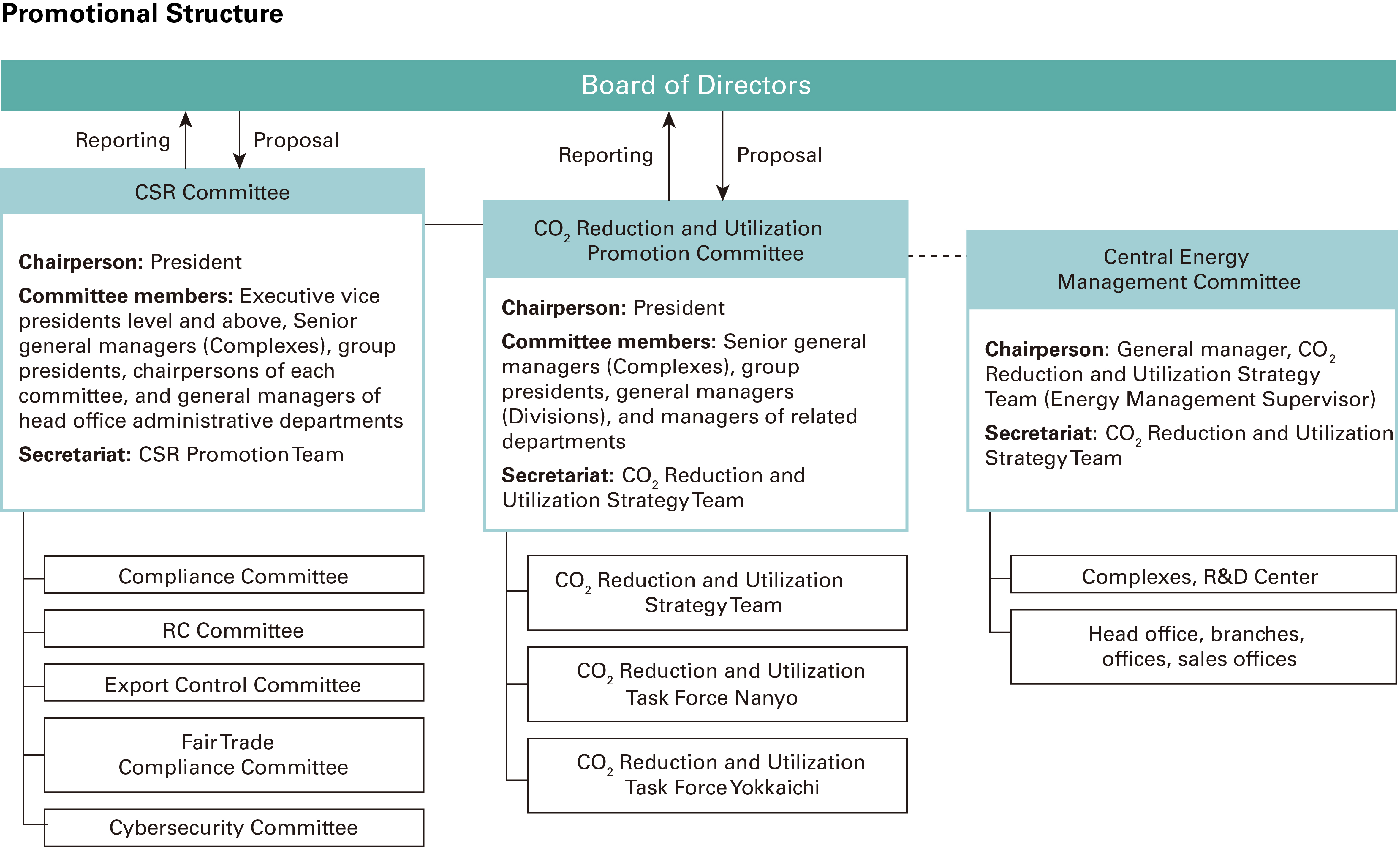

Governance

Tosoh's CSR Committee has identified the response to climate change issues as critical to the CSR mission, and specific measures are being promoted mainly by the CO2 Reduction and Utilization Promotion Committee and its Central Energy Management Committee. The CO2 Reduction and Utilization Promotion Committee plays a pivotal role in collecting information and data on social trends, regulatory requirements, and climate change-related risk management and in sharing this information with Group companies and internally. Matters related to these activities are reported to the Board of Directors for approval when appropriate, and instructions are received when action is required.

Strategies

Conducting scenario analysis will aid the Tosoh Group in ascertaining the impact of climate change-related risks and opportunities, we can then reflect any influential results in our medium- and long-term business plans. The purpose is to formulate strategies to further promote the provision of products, technologies, and services that contribute to solving social issues to realize a sustainable society.

We conducted an analysis based on two temperature rise scenarios—the World Energy Outlook (WEO) NZE 2050 +1.5°C scenario and the Intergovernmental Panel on Climate Change’s (IPCC) SSP5-8.5 +4°C scenario—as well as qualitative and quantitative assessment of transition and physical risk and business opportunities for the 2030 and 2050 time horizons. We also considered the entire supply chain and assessed any foreseeable impact on the Tosoh Group.

In addition to the issues faced by the Tosoh Group as a whole, this year's scenario analysis focused on the Chlor-alkali Group, which accounted for 62% of total Scope 1 and Scope 2 GHG emission volume among the four groups (Petrochemical, Chlor-alkali, Specialty, and Engineering).

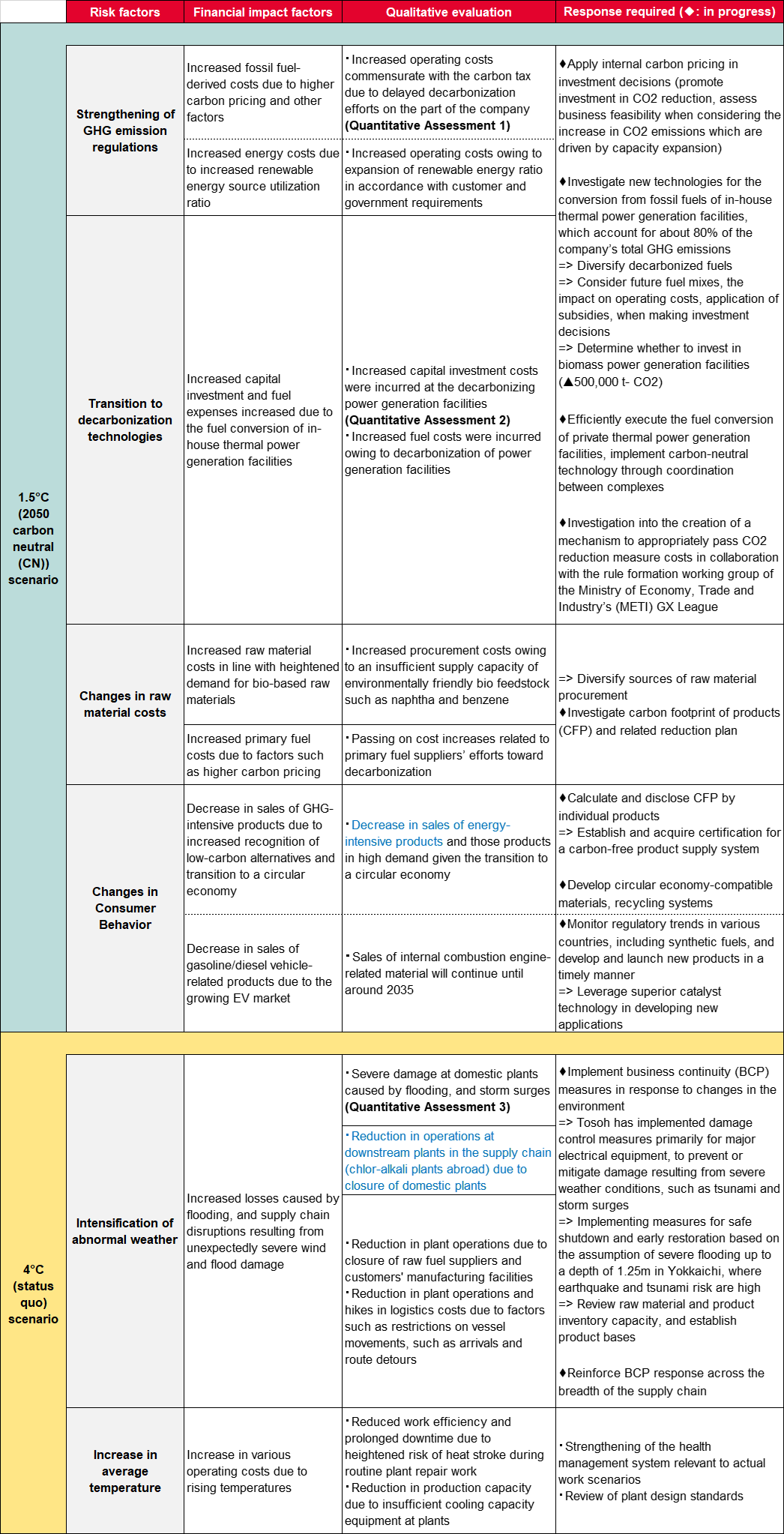

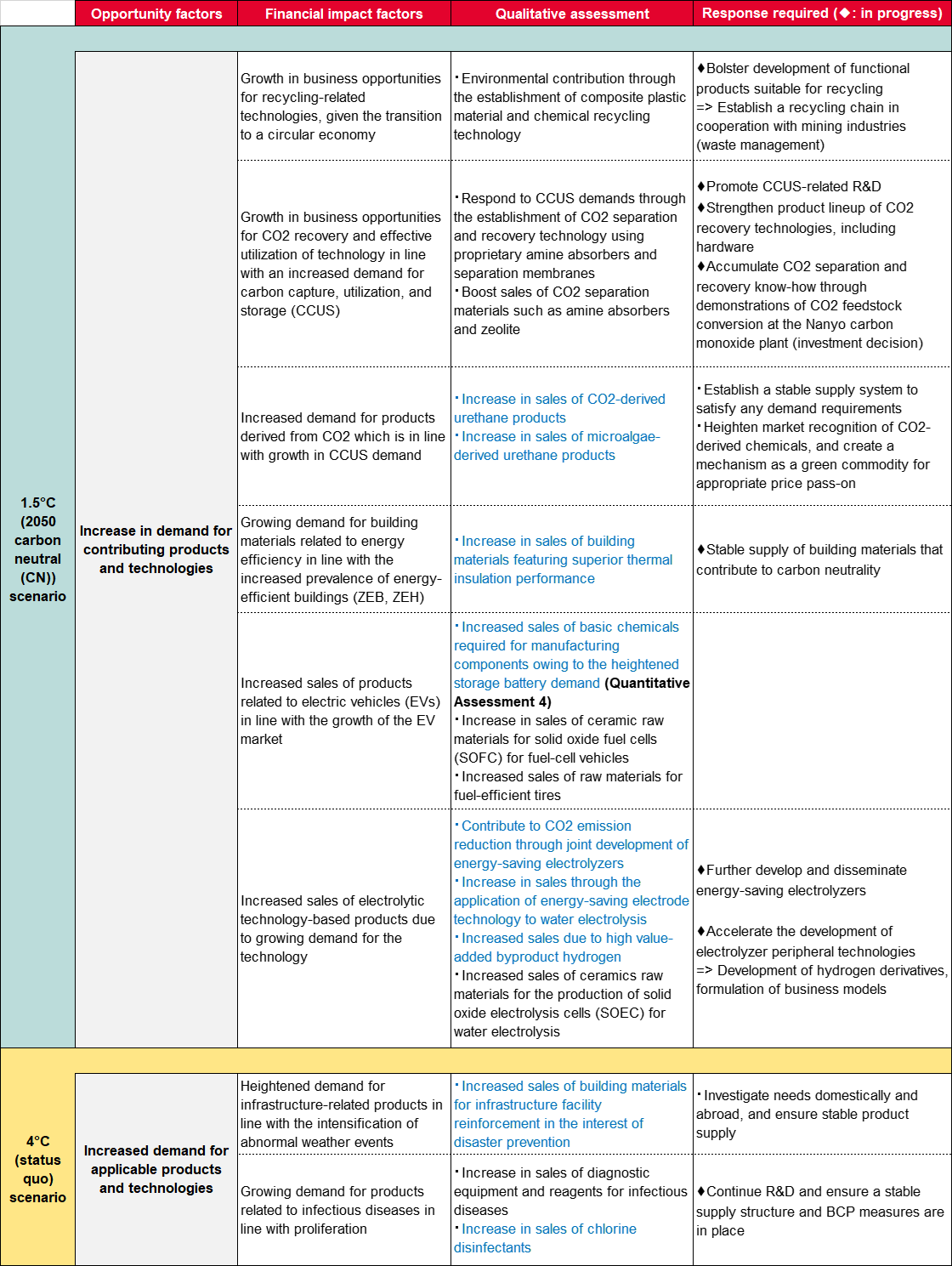

Transition/physical risk

Text in blue characters is related to the Chlor-alkali Group

Details: Please refer to the CSR website for more information on quantitative assessment and calculation methods

Environment (tosoh.com)

Climate Change-Related Business Opportunities

Text in blue characters is related to the Chlor-alkali Group

Details: Please refer to the CSR website for more information on quantitative assessment and calculation methods

Environment (tosoh.com)

Assessment of Tosoh Group Overall

The Tosoh Group's GHG emissions are currently among the highest in the chemical industry, and reducing these emissions is considered essential. We have already launched specific measures related to fuel conversion at our in-house thermal power generation facilities—which account for about 80% of Tosoh’s GHG emissions—and renewable energy procurement, which are vital initiatives. Meanwhile, with regard to business opportunities, we identified potential risks and opportunities spanning a broad range of business domains in both the Commodity and Specialty businesses. Approaching the climate change issue as a good opportunity, we will focus our attention on developing technologies and products for the future from a broader perspective.

Assessment of Chlor-alkali Group

In the Chlor-alkali Group, it has been reconfirmed that rising energy costs have had the single most significant impact on the manufacturing business—as it is a high power-consumption business by nature—and is dedicated to work with the Tosoh Group’s commitment for improvement. Tosoh believes it is also important to devise a mechanism to mitigate the intensity of CO2 emissions during product manufacturing, while also managing the challenges of increases in energy costs by passing some additional cost of low-carbon product production and decarbonization on to product prices. Meanwhile, since the Chlor-alkali Group's products are primarily basic materials, the analysis conducted was not biased one way or the other at this stage, given the broad range of applications and the juxtaposition of uses which constitute either risks or opportunities related to climate change. Demand for these products is steady over the long term, and Chlor-alkali is positioned as one of the main businesses underpinning the Tosoh Group foundation.

Risk Management

Utilizing information on societal trends, and the status of consultations and discussions with the Japanese government, any potential risks posed by climate change issues are assessed through the CSR Committee by each division under its jurisdiction. The CO2 Reduction and Utilization Promotion Committee is responsible for comprehensive risk management for the reduction of GHG emissions and the effective use of CO2. Each division that manages business operation-related risk primarily identifies risks only associated with their own division, they assess the potential financial impact, and report their findings to the president. Risk management in day-to-day business activities is managed independently and overseen by the specific director in charge. Finally, the report is submitted to the Board of Directors for approval and further instructions. Moreover, we apply internal carbon pricing when formulating capital investment plans. Tosoh as a responsible company is careful to not only consider profitability, but also the environmental impact.

Indicators and Targets

1) GHG emission volume

In response to the October 2020 declaration by the Japanese government of carbon neutrality by 2050 and the renewed GHG emissions reduction target for FY2030, Tosoh reviewed its previous target for FY2026 (reduction of non-consolidated BAU* emissions compared with the base year of FY2014) and, in January 2022, established a new groupwide GHG emissions reduction policy.

*Business As Usual (BAU) emissions = production volume x CO2 emission intensity in the base year of FY2014.

- Reduce Scope 1 + 2 GHG emissions by 30% in FY2031 compared with FY2019

- Address the challenge of achieving carbon neutrality by 2050

Actual GHG emissions in FY2023 (10,000 kilotons- CO2e)

| Scope 1: 765 |

Scope 2: 47 |

Scope 3: 586 |

Scope 1 and Scope 2: 8.11 million kilotons- CO2e

2) Disclosure in accordance with climate-related indicator categories

The essential items are as follows.

Tosoh plans to allocate ¥120 billion to climate change-related investment by 2030 and ¥60 billion by FY2025 (based on approved investment amounts).

Major investments

- Construction of the biomass power generation facility at the Nanyo Complex:

→ CO2 emission reduction of approx. 500,000 tons

- CO2 recovery and raw material use at the carbon monoxide (CO) production facility at the Nanyo Complex:

→ CO2 emission reduction of approx. 40,000 tons

Tosoh applies an internal carbon pricing system (¥6,000/ton- CO2) to promote capital investment that contributes to reducing GHG emissions. Internal carbon pricing is also applied in the aforementioned investment decision process.

Details: Please refer to the CSR website for all categories: Environment (tosoh.com)