Tokyo, Japan—Tosoh Corporation presents a summary of its medium-term business plan covering the period from FY2023 to FY2025 as follows.

1. Desired profit structure (by FY 2031)

- Establish Commodity as a profitable business while focusing on decarbonization

Aim to build a profit base of over ¥100 billion in Specialty

2. Basic management policy

- Focus on expanding Specialty earnings while maintaining a dual management strategy based on Commodity and Specialty businesses:

Commodity

Conduct business through the optimal combination of strengthening operations and reducing CO2 emissions; maintain stable supply through appropriate cost burden and price pass-through

Specialty

Invest in businesses that have comparative advantages; allocate management resources to growth areas; expand revenue base by fostering new businesses

- Make a concerted effort to reduce CO2 emissions and effectively use CO2

- Fulfill corporate responsibility to work toward the realization of a sustainable society by promoting decarbonization strategy from all perspectives

- Invest aggressively based on a solid financial foundation

- Decarbonization of society will drastically change the business environment, and the Tosoh Group will seize this opportunity to make timely, strategic investments in preparation for the future

- Reinforce safety infrastructure, establish and deepen safety culture

- Safe plant operation takes precedence over all else; continue efforts to strengthen safety infrastructure, establish and deepen safety culture

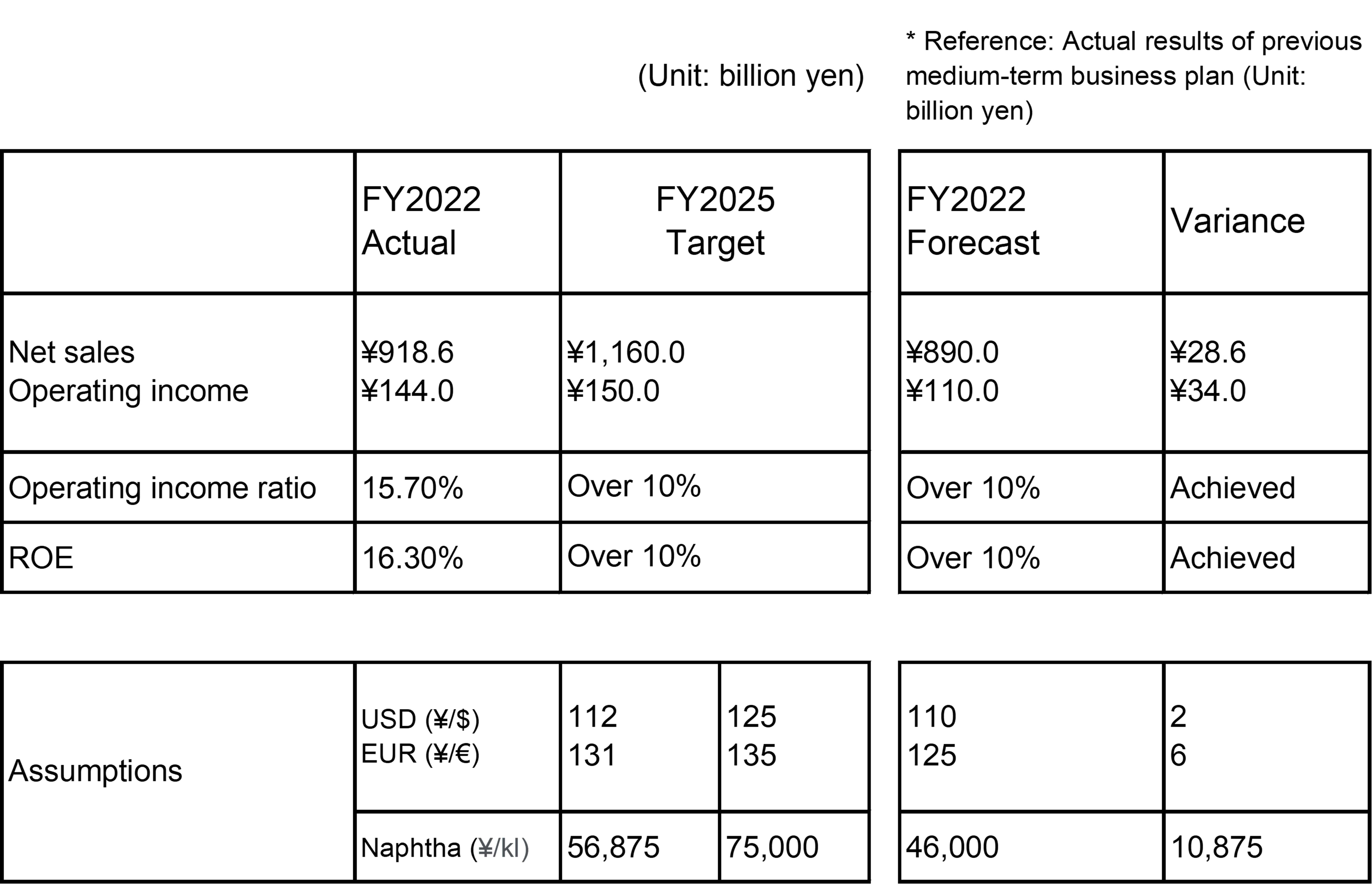

3. Performance

4. Investment and financing plan

- Cumulative investment during FY2023–FY2025 = capital expenditures of ¥200 billion + M&A and additional decarbonization support

- Proactive investment centered on Specialty; capital investment includes ¥30 billion for CO2 reduction

- M&A exploration focused on bio-related fields

Major capital investment plans

Standard investment

- Chloroprene rubber (expansion)

- Bromine and flame retardants (expansion)

- Separation and purification media (expansion)

- Zirconia powder (expansion)

- Methylene diphenyl diisocyanate (MDI) splitter installation overseas

- Sputtering targets (US capacity increase)

- Silica glass materials and fabricated quartzware (expansion)

Investment in CO2 reduction

- Upgrade to circulating fluidized bed boiler

- Installation of additional gas turbine

- Installation of CO2 feedstock conversion equipment at carbon monoxide (CO) plant

5. Research & Development (R&D) objectives

- Concentrate R&D resources in the three priority themes of life sciences, electronic materials, and environment and energy

- Accelerate R&D through effective use of research infrastructure, material design efficiency improvement by leveraging materials informatics technology, promotion of open innovation, and acquisition of cutting-edge technology through funds

6. Shareholder returns

- Strive to improve capital efficiency through share buybacks, while maintaining stable dividends as a basic policy

- Set target for dividend payout ratio of around 30 percent

- Implement share buybacks flexibly, taking into account the level of free cash flow and other factors

7. Decarbonization measures (CO2 reduction targets)

- Implement specific measures to achieve a 30 percent reduction by FY2031 (compared with FY2019)

- Endeavor to achieve 30 percent reduction with current technology through conversion of biomass wood fuel for power generation facilities, and fuel diversification through introduction of a circulating fluidized bed boiler

- CO2 feedstock conversion being a mission for chemical manufacturers, we are assigning it higher priority and strengthening related initiatives

Notes:

This document contains forward-looking statements such as medium-term business plans and forecasts as well as plans, strategies, and financial outlook based on information currently available to the company. The forward-looking statements are subject to various risks and uncertainties that may cause actual results and performance to differ materially from those described.

TOSOH CORPORATION

Who We Are

Tosoh Corporation is the parent of the Tosoh Group, which comprises over 100 companies worldwide and a multiethnic workforce of over 13,800 people. It generated net sales of ¥918.6 billion (US$8.2 billion at the average rate of ¥112.4 to the US dollar) in fiscal 2022, ended March 31, 2022.

What We Do

Tosoh is one of the largest chlor-alkali manufacturers in Asia. The company supplies the plastic resins and an array of the basic chemicals that support modern life. Tosoh’s petrochemical operations supply ethylene, polyethylene, and functional polymers, while its advanced materials business serves the global semiconductor, display, and solar industries. Tosoh has also pioneered sophisticated bioscience systems that are used for the monitoring of life-threatening diseases. In addition, Tosoh demonstrates its commitment to a sustainable future in part by manufacturing a variety of eco-products.

Stock Exchange Ticker Symbol: 4042

DISCLAIMER

This document may contain forward-looking statements, including, without limitation, statements concerning product development, objectives, goals, and commercial introductions, which involve certain risks and uncertainties. Forward-looking statements are identified through the use of the word anticipates and other words of similar meaning. Actual results may differ significantly from the results expressed in forward-looking statements.